Official Press Release: Silverflow Raises €3M

Adyen alums get €3m to launch Silverflow, the first cloud-native card payments platform that connects directly to card networks. Crane Venture Partners and Inkef Capital back Adyen alum startup Silverflow to transform online card payments processing providing an instant upgrade to thousands of industry payments services providers.

Amsterdam and London – 22 October 2020 – Silverflow, a global payment technology company, is announcing a €2.6m seed funding round, led by UK-based seed-stage investor Crane Venture Partners with participation from INKEF Capital and notable angel investors and industry leaders from Pay.On, First Data, Booking.com and Adyen. With this seed round, Silverflow has now raised €3m in total funding.

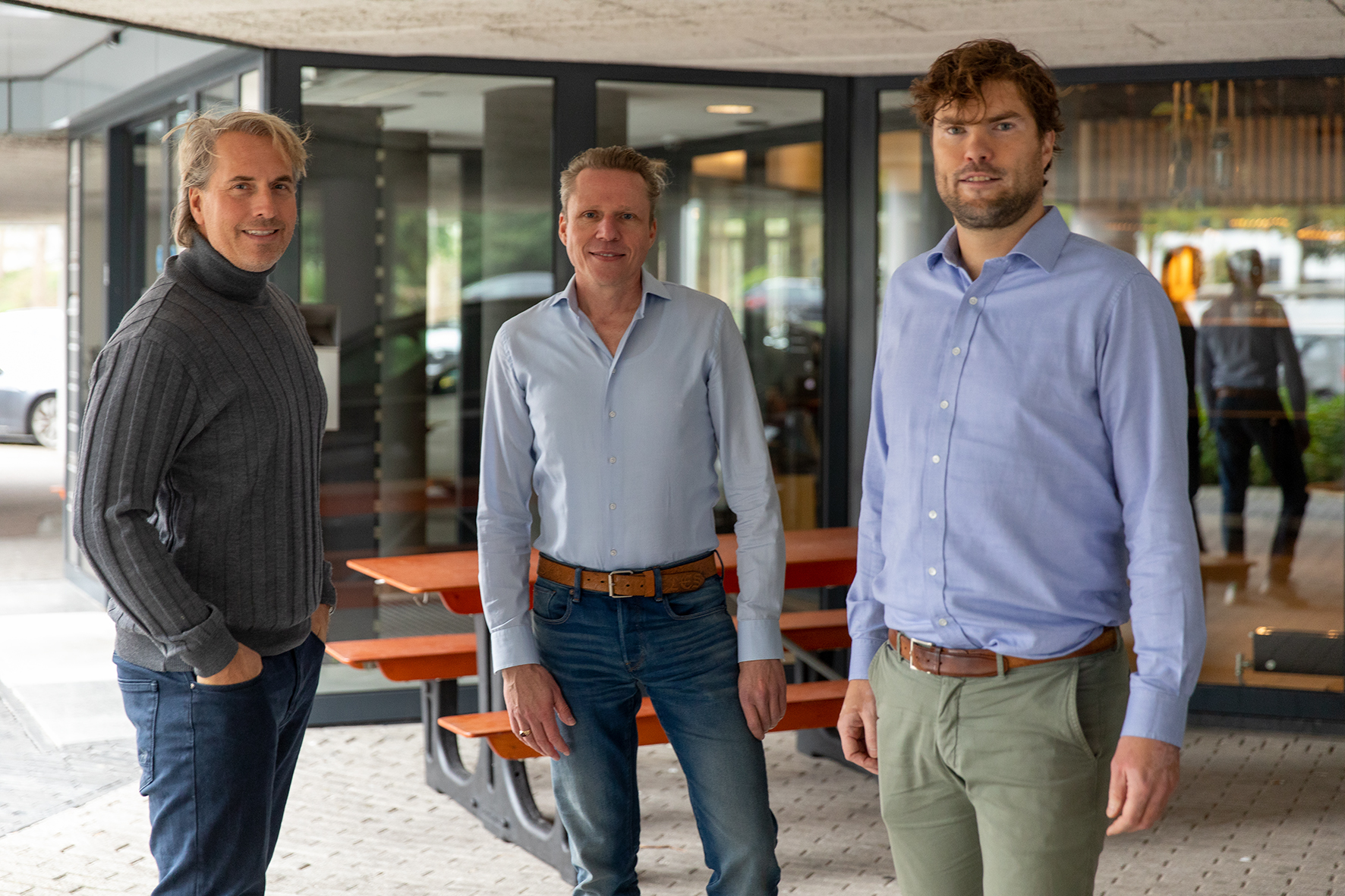

Silverflow is a payments technology company building a modern and easy-to-use cloud platform for global cards processing with direct access into the card networks. Founded by long-time online payments industry veterans and seasoned startup founders CEO Anne-Willem de Vries (who was focused on card acquiring and processing at Adyen), CBDO Robert Kraal (former Adyen COO and EVP global card acquiring & processing of Adyen) and CTO Paul Buying (founder of acquired translation startup Livewords), Silverflow will launch its card payments processing technology in early 2021.

Anne Willem de Vries, CEO and cofounder of Silverflow, commented:

Today’s card payment infrastructure is based on 30 to 40-year-old technology that’s still in use across the global payment landscape. The payment technology infrastructure costs everyone time and money: consumers, merchants, payment-service-providers, and banks. We founded Silverflow with the belief that the payments technology stack needs an upgrade.

Silverflow is the first card payments processor with a cloud-native platform built for today’s technology stack, with simple APIs and streamlined data flows, that is directly integrated into card networks. Silverflow is made for payment service processors (PSPs), acquirers and global top-market merchants that are seeing €500mn-10bn in annual transactions. Instead of customers needing to manage a complex network of acquirers across markets and maintain dozens of bank and card network connections Silverflow provides card acquiring processing as a service that connects to card networks directly through a simple API.

Krishna Visvanathan, Partner at Crane Venture Partners, added, “Our mission at Crane is to back entrepreneurs who are redefining the enterprise technology stack and Silverflow epitomises this as it relates to global card processing. Whilst payments power the digital economy, existing backend processing technology is old, costly and inflexible – and ripe for reinvention. Silverflow’s founders are a powerhouse team of payments industry experts with a unique insight to building a product that transitions PSPs, acquirers, and merchants from inflexible legacy systems to a fully cloud-native modern architecture. We are proud to be supporting them as they launch and scale their card payments-as-a-service platform globally.”

Silverflow is a team of five employees based in Amsterdam. The new seed funding round will enable Silverflow to double its team by the end of 2020, adding new developers and a commercial director. Silverflow has been in development for over two years and will be ready to launch in early 2021.

Angel investor Marcus Mosen, senior payment executive, industry advisor and early investor in fintechs like Iyzico or N26, added:

I’m proud to support the founding team at Silverflow as they get ready to launch a truly innovative payments technology platform. Silverflow is the solution to bring innovation to the payments tech stack through intuitive card network connections and processing. Reducing the complexity and cost of managing a network of card processing solutions, Silverflow brings modern technology, smart data insights and the ability to roll out new products across markets with its new card payments processing technology.

About Silverflow

Silverflow is a global payments technology company, founded by online payments industry veterans, with the mission to accelerate technological innovation in the payments industry. Silverflow’s cloud-based platform provides a state-of-the-art upgrade and direct access to the card networks for payment services providers, merchants and acquirers. Its intuitive product and scalable technology provides value, creates efficiencies, and drives new opportunities for all. Based in Amsterdam, Silverflow is backed by Crane Venture Partners, INKEF Capital and notable angel investors from Pay.On, First Data, Booking.com, and Adyen. Learn more: www.silverflow.com

About Crane

Crane is a London-based VC firm focused on early-stage investments in European start-ups that are solving real problems for the enterprise and enterprise workers. We back ambitious founders building category defining companies who are redefining the enterprise stack. Crane’s portfolio includes 7Bridges, Axiom, Foundries, Harbr, Onfido, Shipamax, Tessian and Virtuoso. Learn more: www.crane.vc

About INKEF

INKEF Capital is a venture capital firm based in Amsterdam, backing promising early stage companies in Europe. Notable recent investments include Gitlab, Geophy, Urban Sports Club, Happeo and Remote. INKEF takes pride in being a patient, long-term investor with the ability to support companies through several rounds of funding. From the early stages of a technology or life science venture, INKEF Capital supports entrepreneurs building their ideas into successful international businesses. Learn more: www.inkefcapital.com.

Read also

Reflections from ETA Transact 2025: A Silverflow Perspective

Read our recap of ETA Transact 2025, where we joined industry leaders in Las Vegas to discuss the future of...

Q2 2025: Silverflow Product Updates

Welcome to your quarterly update on the latest and greatest product updates from Silverflow. Find out what's new and see...

Q2 2025: Card Scheme Updates

Your quarterly update for card scheme changes and what they mean for you!